Summer Financial Aid (SFA) Requests

summer financial aid (sfa) requests

Financial assistance may be available if you're attending classes during the summer, but it's different from fall and spring because of the condensed timeframe and unique eligibility criteria. It is also an additional application you must complete.

application requirements

- Complete your 2025-2026 FAFSA.

- Complete any financial aid requirements.

- Review the SFA Request Terms & Conditions.

- Submit this SFA Request Form

Process Status Disclaimer Application Available Now Before requesting aid for the summer, it is crucial to understand the requirements, details for each aid program, and how your fall/spring aid will be affected. Click each + below and review the information provided Processing Schedule Begins on May 1 If you have chosen to borrow only enough to cover your charges, your SFA request will be reviewed and processed after the Office of Student Accounts (OSA) generates bills. Bills Generated Begins May 5 Bills are due mid-July. Have a plan in place or aid credited toward your bill to avoid OSA's $100 payment extension fee. Aid Disbursment Begins Mid-July Scheduled to pay after add/drop of summer 3 has ended.

application changes.

The process to request aid in the summer has changed! Paper forms are no longer, and the application is now available electronically through Student Forms → MILLERSVILLE.STUDENTFORMS.COM

- You must create a Student Forms account.

- Click Manage Requests in your Student Forms account.

- Select the Summer Financial Aid Request workflow.

- Complete and submit the form.

- Wait for the application to be reviewed.

- Refer to the review and processing times listed below.

Need help?

View our step-by-step guide (pictures included), so you can complete the SFA Request with ease!

Click the + next to the section below—STEP 2: FOLLOW INSTRUCTIONS TO APPLY.

-

STEP 1: READ IMPORTANT INFO ABOUT THE AID YOU'RE REQUESTING

Summer financial aid works a little differently than fall or spring. Your eligibility depends on more than just submitting the FAFSA—it also factors in your enrollment, academic progress, and the types of aid you're requesting. Some aid may reduce what’s available to you during the regular academic year, so it's important to understand how everything fits together before making a request.

Below, you'll find the general eligibility requirements, details about each aid type, and how summer aid could impact your fall and spring awards.

General eligibility criteria

FAFSA and completed aid requirements. PA residents file by May 1. Enrollment in a degree-seeking program Take courses that count toward their degree or Course Program of Study (CPOS). Meet Satisfactory Academic Progress standards. Maintain at least half-time enrollment to be eligible for all federal loans and some private loans.

Disclaimer: If half-time enrollment is required for the aid program listed below, your status will be determined by the total number of credits you are enrolled in throughout the entire summer semester. Half-time enrollment is defined as 6 credits for undergraduate and post-baccalaureate certification students and 3 credits for graduate and doctoral students.

PA State Grant

Category Details Applications - Complete the FAFSA

- Submit Millersville's Summer Financial Aid Request

- Submit a Summer PA State Grant Application to PHEAAEligibility - Undergraduate, degree-seeking

- Be enrolled at least half-time over a minimum 5-week period

- Must meet CPOS and SAP standards

- Demonstrate financial need per PHEAA criteriaImpact - Counts toward the 8 full-time semester maximum for PA Grant use

- Using a grant in summer may reduce future eligibilityDisbursement - PHEAA does not notify Millersville of award amounts until August

- CANNOT be used as a credit toward your bill

Federal Pell Grant

CategoryDetails Applications - Complete the FAFSA only – no additional applications required Eligibility - Undergraduate, degree-seeking

- Must meet CPOS and SAP standards

- Demonstrate financial need per FAFSAImpact - Counts toward your Lifetime Eligibility Used (LEU) – max 6 years

- May be eligible for a full-time award in the summer if enrolled full-timeDisbursement - Can be used toward your bill

- Pays in August

- May be adjusted if you drop, fail, or withdraw from a course

Federal Direct Loan

Category Details Applications - Complete the FAFSA

- Submit Millersville's Summer Financial Aid Request

- Indicate intent to use federal loansEligibility - Undergraduate or graduate

- Must be enrolled at least half-time

- Must meet CPOS and SAP standardsImpact - Uses a portion of your annual loan limit

- Automatically triggers fall/spring loan processing

- Recommended to limit loan to summer balance only for flexibilityDisbursement - Pays in July

- Can be used as a bill credit

- May be adjusted if enrollment changes before disbursement

Federal PLUS Loan (Parent or Graduate)

Category Details Applications - Complete the FAFSA

- Submit Millersville's Summer Financial Aid Request

- Applications at studentaid.gov/plus-app

- Borrower must indicate intent to use in summerEligibility - Undergraduate (Parent PLUS) or Graduate (Grad PLUS)

- Must be enrolled at least half-time

- Must meet CPOS and SAP standards

- Must pass a credit checkImpact - Strongly recommended to request loans for the entire academic year (05/2025–05/2026) to preserve need-based aid

- Only borrow what is needed

- Recommended to limit loan to summer balance

- Fall/spring reductions must be requested separately after bills are issuedDisbursement - Pays in July

- Can be used toward your bill

- May be adjusted if enrollment changes before disbursement

Private Loan

Category Details Applications - Complete the FAFSA

- Submit Millersville's Summer Financial Aid Request

- Applications through a lender of your choice (e.g., elmselect.com)

- Indicate intent to borrow on the formEligibility - Each lender has its own requirements

- Must meet CPOS and SAP standards, if applicable

- Credit check required; cosigner may be neededImpact - Strongly recommended to request loans for the entire academic year (05/2025–05/2026) to preserve federal aid eligibility

- Only borrow what you need

- Recommended to limit loan to summer balance

- Fall/spring reductions must be submitted separately after bills are issuedDisbursement - Pays in July

- Can be used toward your bill

- May be adjusted if enrollment changes before disbursement -

STEP 2: FOLLOW INSTRUCTIONS TO APPLY

Learn each step of the process for summer aid—from what to do first, requesting and completing the application, to waiting for your request to be reviewed and processed.

Disclaimer: If you only want grants, you are not required to complete this form, but can do so if you'd like.

- Pell Grant Only? If you're eligible, the Pell Grant will be automatically applied based on your enrollment.

- PA State Grant? You must apply directly through pheaa.org for summer consideration.

Use this step-by-step guide to complete your application

✅ Step 1: Log In to Student Forms

- Go to studentforms.com

- Log in using your MU credentials.

If this is your first time logging in for the academic year(e.g. May 2025–May 2026, or May 2026-May 2027, etc.) you'll be prompted to set up your account.

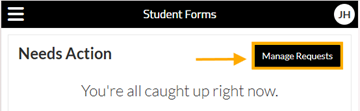

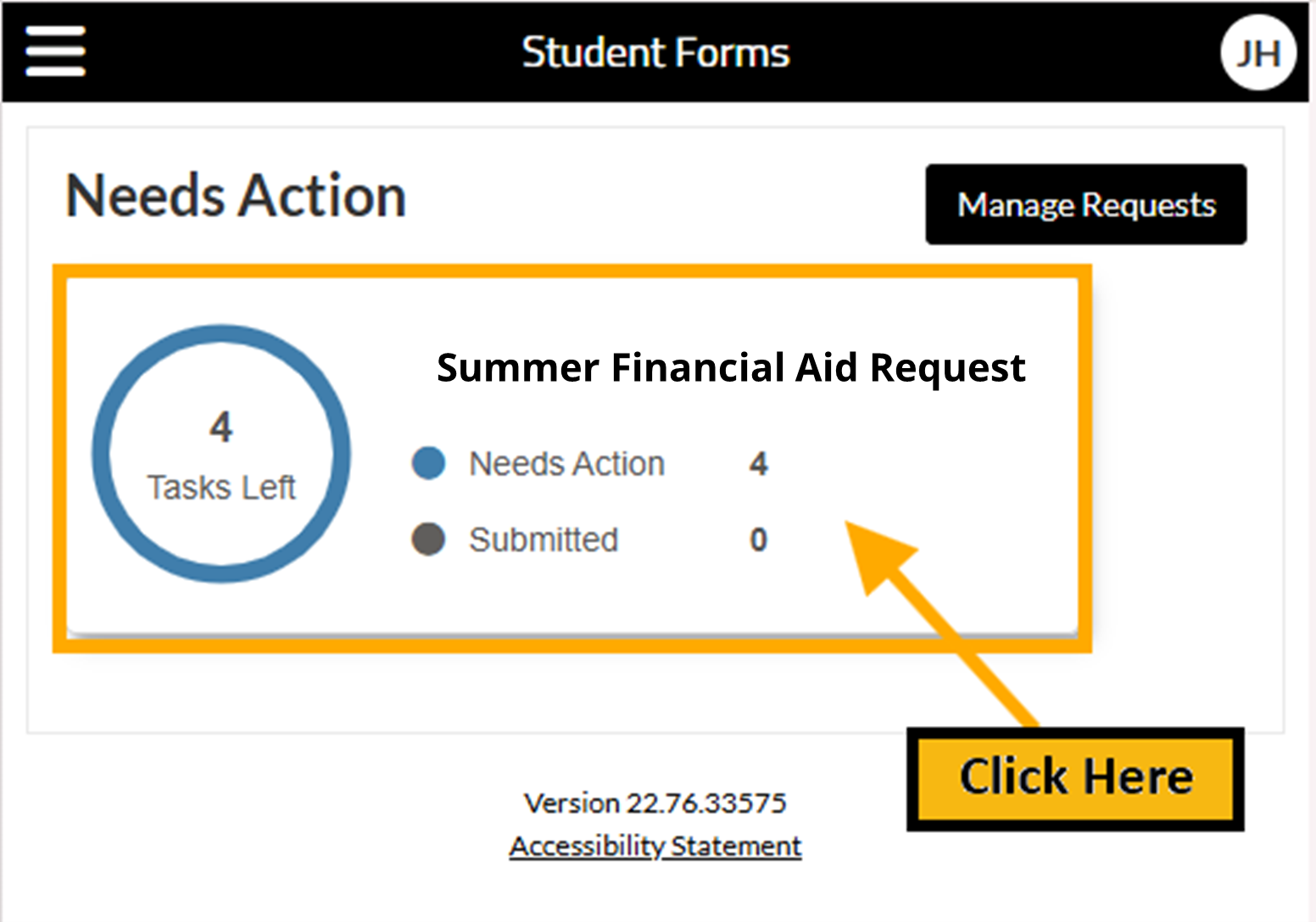

✅ Step 2: Go to “Manage Requests”

- You’ll land on the Needs Action

- Click Manage Requests on the top right.

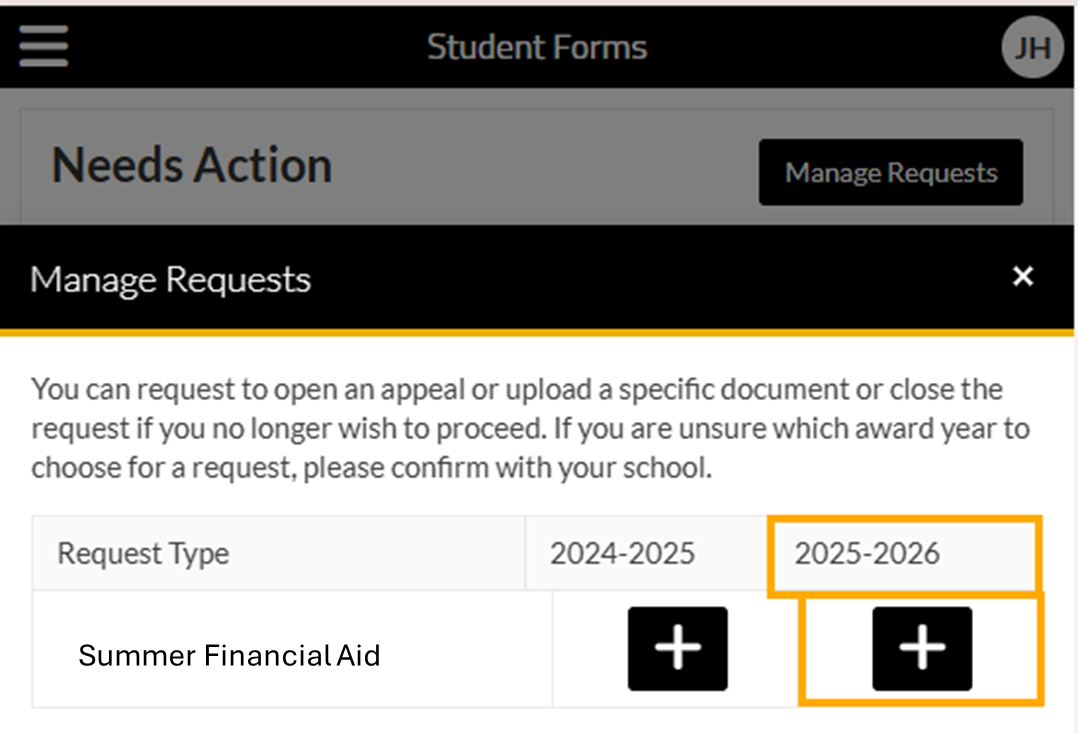

✅ Step 3: Select the latest Aid Year & Add the Form

- Scroll to find the Request Type: Summer Financial Aid (SFA).

- Under the header for the latest academic year, click the ➕ (plus sign) next to the SFA Request to add the form to your account.

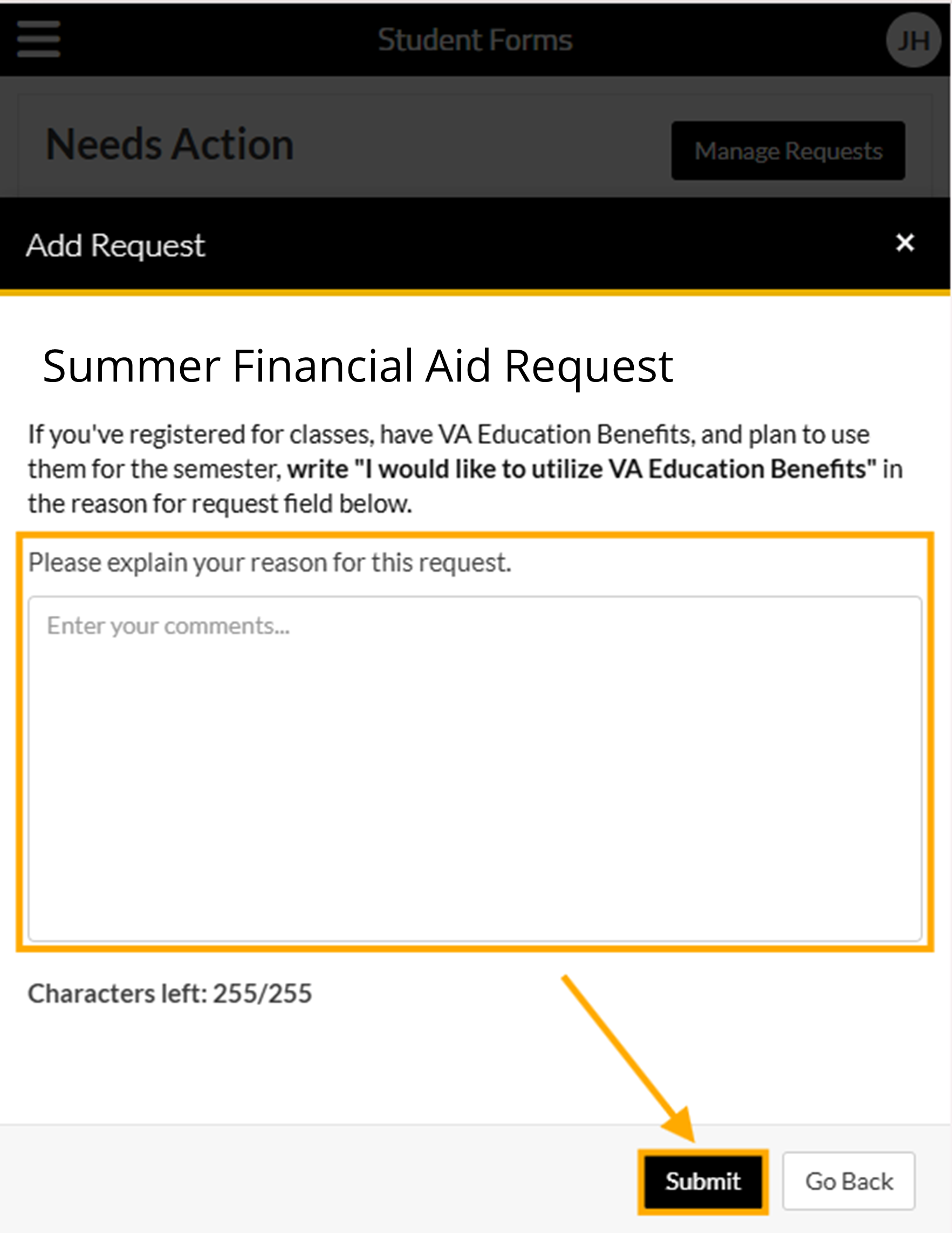

✅ Step 4: Enter Reason for Request

- In the pop-up box, enter a brief explanation. Then click Submit.

- Examples:

- "I am requesting to use some of my federal loans in summer."

- "I plan to apply for a private loan for summer."

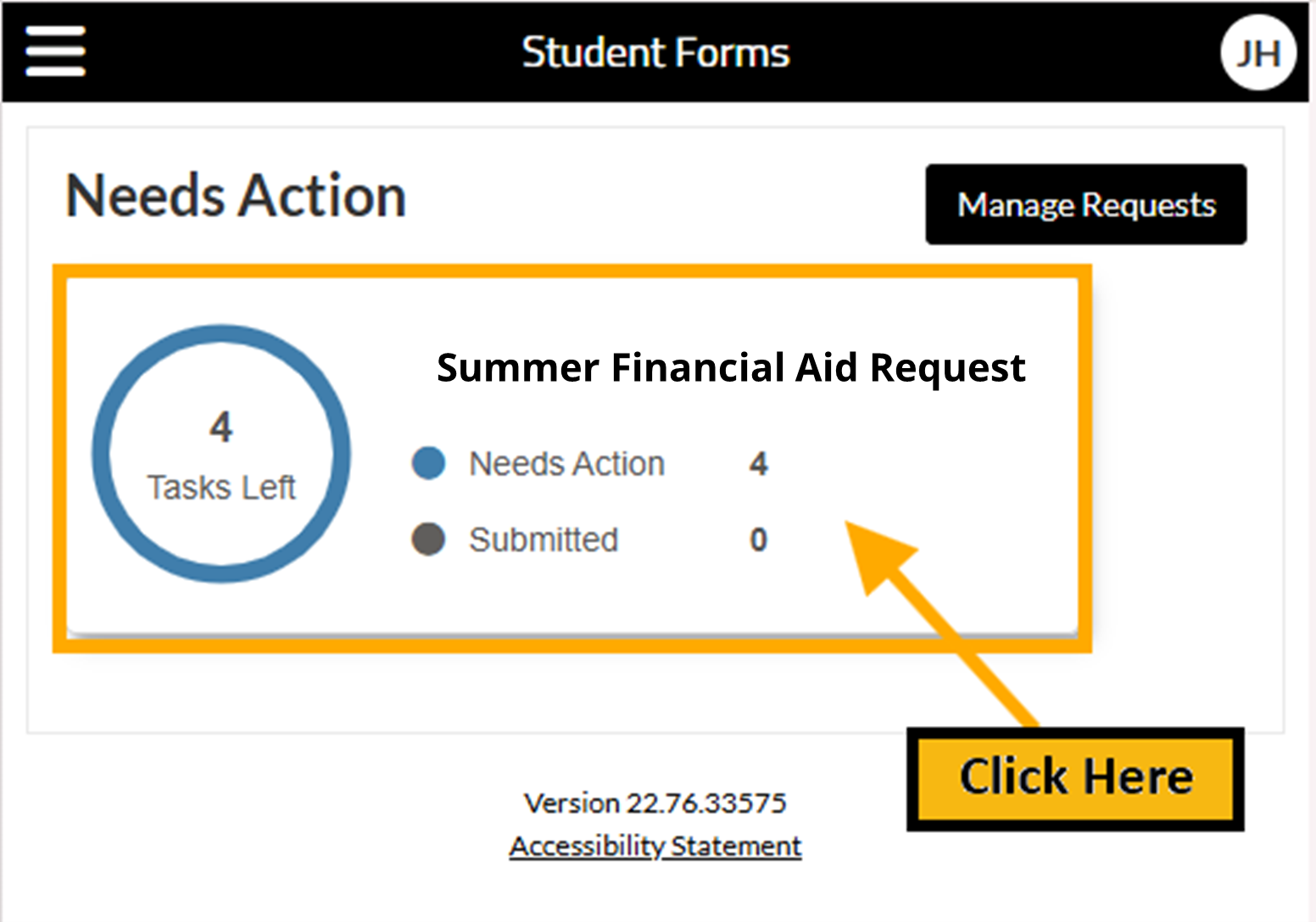

✅ Step 5: Form Becomes Available

- After submitting, a pop-up confirmation message will appear— click OK to move on.

✅ Step 6: Begin Form

- Click to begin completing the form.

✅ Step 7: Complete Form

- Complete all sections of the form and do not leave anything blank.

- Choose your program level.

- Read each aid type carefully.

- Select only the aid you intend to use.

- Check the disclaimers to learn how the aid is used.

- If you indicate the intent to apply for a PLUS or private loan, make sure an external application is completed.

- Acknowledge your understanding of summer aid, your request, and your responsibilities.

- If requesting loans, consider reducing your debt and only use what you need.

- Read disclaimers.

✅ Step 8: Submit your form.

- Sign the form electronically and then click submit to close the form itself.

- Then, make sure to click FINISH. If you don't complete this step, we won't receive your application.

Once you submit your SFA Request, you can check its status on your MAX account under Student Requirements on the homepage of your Financial Aid Overview.

Requested:

You initiated the application on Student Forms, but it has not been submitted.

Received, Not Yet Reviewed:

We are working on entering your request.

Ready for Processing:

Your information has been received, entered into the system, and placed in the queue for processing.

Satisfied

Your form has been reviewed and completed. You can view your aid in MAX under the Offer tab in your Financial Aid Overview.

Denied

Your form has been reviewed, but you are not eligible for the aid requested.

📅 Please allow 5-10 business days for your form to be reviewed and processed.

⚠️ Your request will not be processed until your summer enrollment matches what is listed on the SFA form.

⚠️ Review the section for other potential processing delays.

If you have questions, contact the Office of Financial Aid: fa.mail@millersville.edu

-

STEP 3: REVIEW THE Standard Processing Timeline

Once you submit your SFA Request, you can check its status on your MAX account under Student Requirements on the homepage of your Financial Aid Overview.

Requested: You initiated the application on Student Forms, but it has not been submitted. Received, Not Yet Reviewed: We are working on entering your request. Ready for Processing: Your information has been received, entered into the system, and placed in the queue for processing. Satisfied Your form has been reviewed and completed. You can view your aid in MAX under the Offer tab in your Financial Aid Overview. Denied Your form has been reviewed, but you are not eligible for the aid requested. 📅 Please allow 5-10 business days for your form to be reviewed and processed.

⚠️ Your request will not be processed until your summer enrollment matches what is listed on this form.

-

STEP 4: LEARN POTENTIAL PROCESSING DELAYS

Reason for Delay Details Satisfactory Academic Progress (SAP) If you’re at risk of not meeting SAP, your form will be held until SAP reviews are complete. Incomplete Verification Processing may be delayed if your FAFSA data requires verification, including documentation for dependency status, personal identifiers, etc. Outstanding Requirements Any other unresolved financial aid requirements (such as forms, documents, or corrections) must be completed before processing can begin. Internal Review If you're undergoing a financial aid internal review, such as:

- Pell Lifetime Eligibility Used (LEU)

- Federal Loan Limit Review (LLR)Enrollment Mismatch (Optional addition) Your enrollment must match what’s listed on your Summer Financial Aid Request. Updates require a Change of Enrollment form. -

STEP 5: KNOW HOW enrollment changes CAN AFFECT YOUR REQUEST

Student-Initiated Changes:

If you need to make changes to your SFA request, follow the general guidelines below:

-

The application has already been processed: Complete a Change of Enrollment form for credit adjustments and/or a Loan Change Request form to request adjustments to your aid.

- The application has NOT been processed yet: Contact the Office of Financial Aid by email: fa.mail@millersville.edu

Other reported enrollment changes

If an enrollment change is reported, your aid may need to be adjusted. When the enrollment change occurs, whether your aid has been paid or not determines if adjustments will be made to your aid.

Disclaimers:

- The federal Pell grant is an entitlement and will be updated to your eligible award amount, but it may not happen immediately. Contact our office to see if you can request that the review be expedited.

- Loan changes do not happen automatically—even if you requested to cover your bill. You must notify our office if you want to make an adjustment.

-

-

step 6: REVIOEW THE BILLING and DISBURSEMENT TIMELINES

Bill due dates are determined by the Office of Student Accounts (OSA) and depend on the start and end dates of the courses you are enrolled in.

Some types of summer aid can be used as a credit toward your bill, while others cannot. Some may also depend on factors such as whether external applications have been received or if items are incomplete.

Refer to the chart below for more details.

Financial Aid Type

Anticipated Disbursement Date

Can it be used as a credit toward my bill?

PA State Grant

August

NO

Federal Pell Grant

August

YES - if all financial aid requirements are complete.

Federal Direct Loans

Mid July

YES - if all financial aid requirements are complete.

Federal PLUS Loans

Mid July

YES - if all financial aid requirements are complete.

Private Loans

Mid July

YES - if all financial aid requirements are complete.